What are consumers saying about meat alternatives

Research | February 24, 2019

Cell-cultured meat has created some new scenarios not imagined just a few months ago – should this product be called meat? How will it be regulated?

It was recently announced that USDA and FDA would be sharing responsibility for regulating the bold new world of cell-cultured meats. Traditionally, the division of authority between the two agencies has been a hard line, though difficult to follow at best and illogical at worst.

While the tag-team regulatory approach for cell-cultured meats is still being decided, a larger question looms for technology developers, investors and food manufacturers: Will consumers eat it?

The marketplace is preparing to offer these meats in the near future, marketers and brand managers are looking for answers to these questions:

At Look East, we use Magnify, a unique research software that digitally analyzes thousands of consumer conversations to provide a fascinating set of cultural insights. This rich data allows us to see how new topics, such as meat alternatives, are emerging and trending with consumers. Thousands of real-time data points are synthesized and analyzed to create a report that informs brand and marketing strategy. This new offering is called Magnify, and it enables us to observe online conversations and behavior, giving an untainted look at the beliefs and motivations that form consumer opinions.

At Look East, we use Magnify, a unique research software that digitally analyzes thousands of consumer conversations to provide a fascinating set of cultural insights. This rich data allows us to see how new topics, such as meat alternatives, are emerging and trending with consumers. Thousands of real-time data points are synthesized and analyzed to create a report that informs brand and marketing strategy. This new offering is called Magnify, and it enables us to observe online conversations and behavior, giving an untainted look at the beliefs and motivations that form consumer opinions.

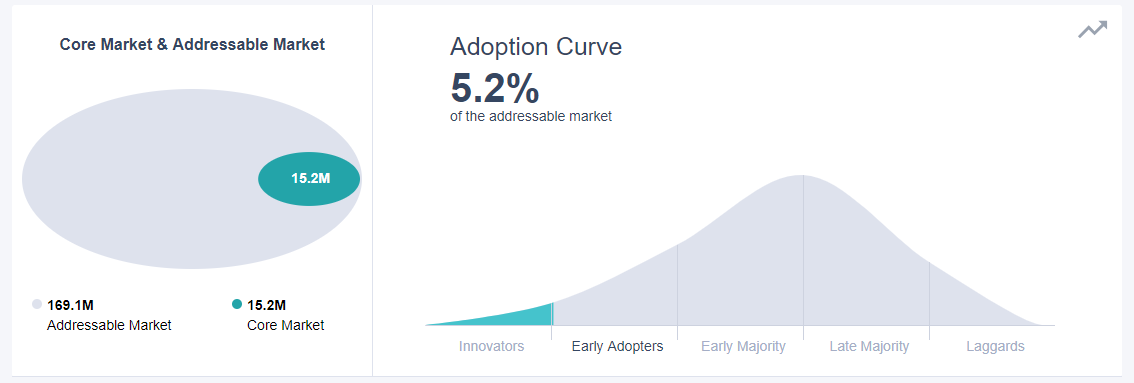

An inside look at demographics shows that the people interested in meat alternatives are not the traditional meat buyer. People currently talking about alternative meats are very early adopters – trendsetters if you will.

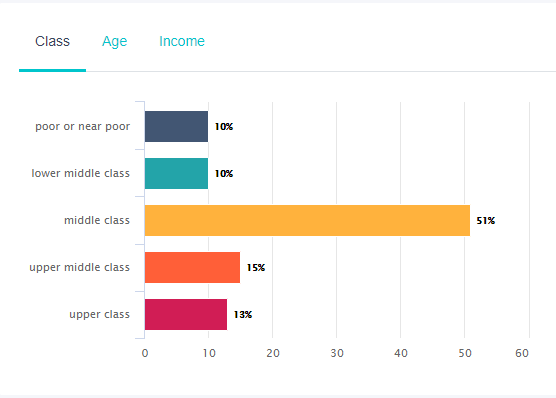

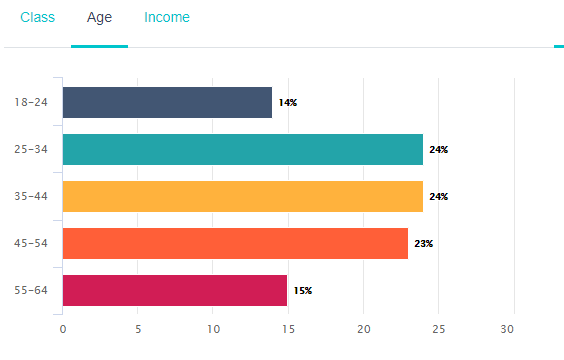

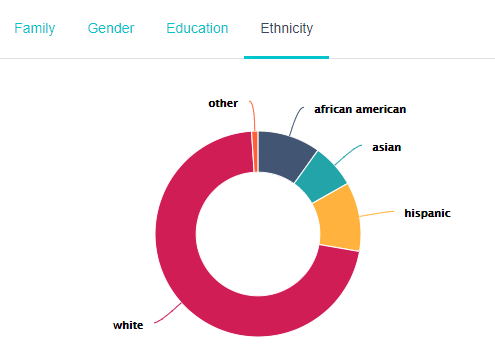

To further identify these early adopters, 51 percent are in the middle class and range from 25 to 54 years of age. Most are single (40 percent), though evenly split between genders and education level. About 70 percent of the focused demographic are Caucasian.

To further identify these early adopters, 51 percent are in the middle class and range from 25 to 54 years of age. Most are single (40 percent), though evenly split between genders and education level. About 70 percent of the focused demographic are Caucasian.

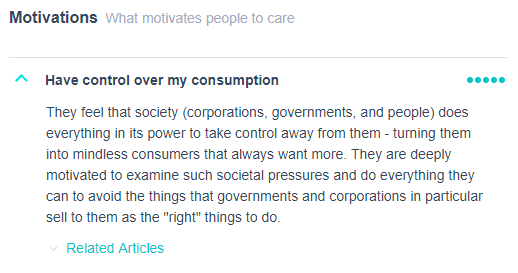

A deeper dive into Magnify, our digital intelligence tool, reveals that one of the main motivators of those discussing meat alternatives is helping the environment and taking control of their food choices. The food system has experienced a major shift in the past decade with consumer demands altering the way companies and farmers grow and provide food. Additionally, consumers choose to use food as a way of showcasing their sense of self through what they consider their higher set of values and purpose. Their largest fears are that they won’t make a difference and could leave the planet uninhabitable.

A Magnified look shows that consumers conversing about meat alternatives demonstrate attitudinal themes that include:

Thankfully, with the help of our digital intelligence tool, we can gain a deeper understanding of these themes.

Aided by the research, communication and engagement with those interested in meat alternatives can be developed in a manner that truly speaks to the heart of their motivations, fears, attitudes and values.

Magnify shines a clear lens on the consumer values, beliefs and vulnerabilities related to food and agriculture – from farm to fork. It serves as a key, of sorts, that unlocks the door to meaningful engagement. Whether your goal is to address an issue, market a new product or perhaps compete with an existing product, Magnify insights are key to understanding your audience and how to talk to them. If you’re interested in taking a Magnified look at a product, brand, topic or trend, you know where to find us.